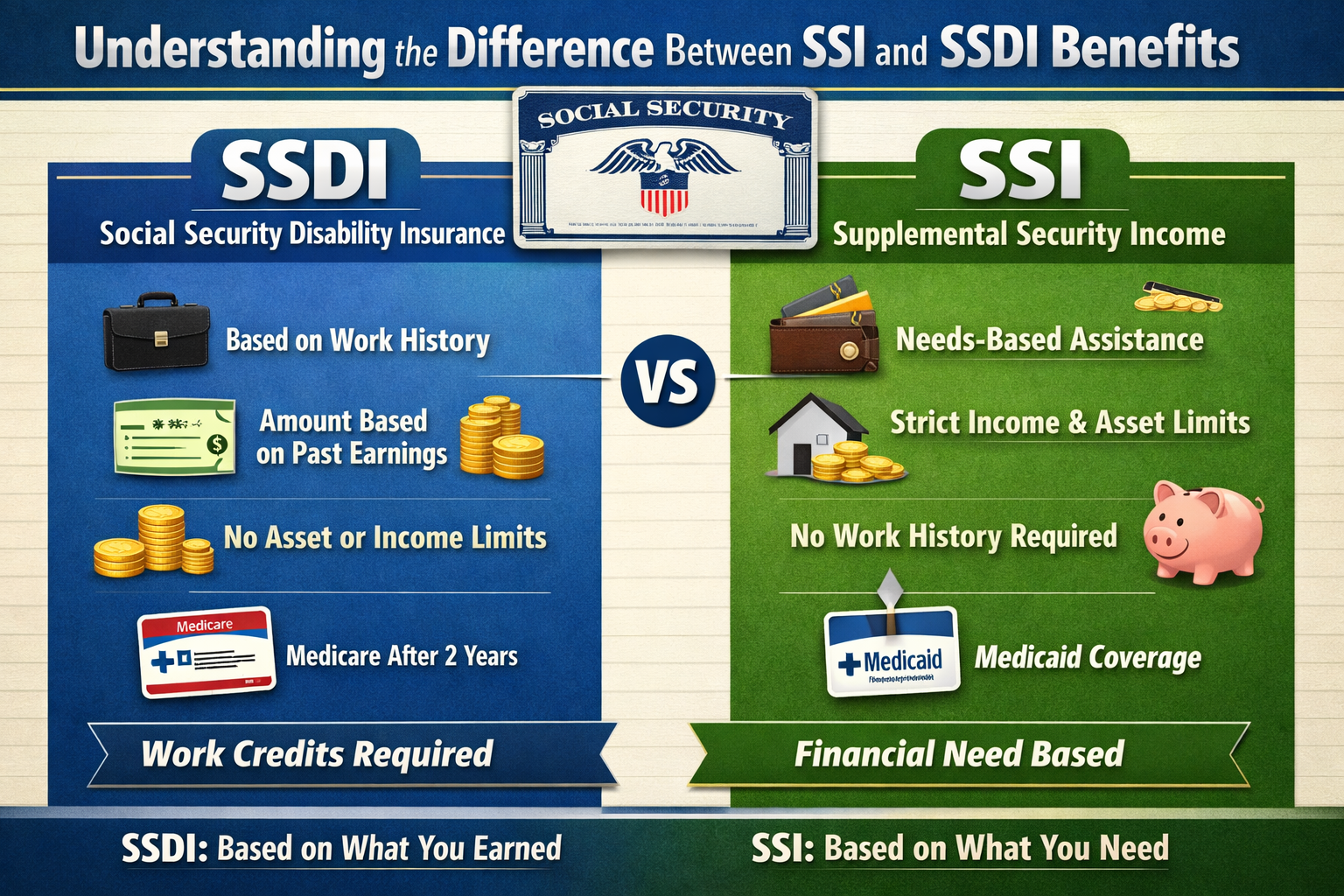

If you have ever felt confused about disability programs, you are not alone. Many people searching for financial support quickly realize they need help with understanding the difference between SSI and SSDI benefits. At first glance, both programs seem similar because they are managed by the Social Security Administration and both support individuals with disabilities. Look closer, though, and you will see that they operate under very different rules.

Let’s break it down in plain terms so you can see which one might apply to your situation.

What Is SSDI?

Social Security Disability Insurance, often called SSDI, is built around your work history. Think of it as an insurance policy you have been paying into through payroll taxes. If you worked and paid Social Security taxes for enough years, you earned work credits. Those credits are what make you eligible for SSDI.

Here is what matters most with SSDI:

- You must have a qualifying disability.

- You must have earned enough work credits.

- Your benefit amount depends on your past earnings.

- Your assets and savings do not affect eligibility.

This last point surprises many people. SSDI does not look at your bank account, property, or investments. It focuses on whether you worked long enough and whether your medical condition meets the strict disability definition.

In most cases, you need about 40 work credits, with 20 earned in the last 10 years before becoming disabled. Younger workers may qualify with fewer credits.

What Is SSI?

Supplemental Security Income, or SSI, is very different. It is a needs based program. It is designed for people who are disabled, blind, or over age 65 and have very limited income and resources.

Unlike SSDI, SSI does not require a work history. You could qualify even if you never worked a formal job. That makes it a safety net for people who cannot build work credits due to disability early in life or other circumstances.

Here is what SSI looks at:

- Your income, including wages, pensions, or family support.

- Your resources, such as cash, savings, and certain property.

- Your living arrangements.

SSI has strict financial limits. If your countable resources exceed the allowed threshold, you will not qualify. Certain items, like your primary home and one vehicle, may not count against you, but cash and savings usually do.

The benefit amount for SSI is generally lower than SSDI and is based on a federal base rate, sometimes supplemented by state payments.

The Core Difference, Work History vs Financial Need

Here’s the thing. The biggest dividing line between the two programs comes down to this question:

Did you work and pay into the system long enough?

If the answer is yes, SSDI might be your path. If the answer is no, and your income and resources are limited, SSI may be the option.

SSDI rewards your work history. SSI focuses on financial hardship.

That difference shapes everything else, from eligibility to payment amounts.

How Benefit Amounts Are Calculated

With SSDI, your monthly payment depends on your past earnings. The Social Security Administration uses your lifetime work record to calculate an average, then applies a formula to determine your benefit.

This means someone who earned a higher income over many years will typically receive a larger SSDI check than someone with lower lifetime earnings.

SSI works differently. The federal government sets a base monthly amount. If you have other income, your SSI payment may be reduced. If your state offers a supplement, you may receive slightly more.

In simple terms:

- SSDI payments vary based on what you earned.

- SSI payments are mostly fixed and adjusted by income.

Medical Eligibility, The Same Standard

One area where SSDI and SSI are similar is the medical requirement. Both programs use the same definition of disability.

You must have a condition that:

- Prevents substantial gainful activity.

- Is expected to last at least 12 months or result in death.

This is not about short term injuries or temporary illnesses. The standard is strict. Many applications are denied at first because the medical documentation does not fully support the claim.

Can You Qualify for Both?

Yes, some people qualify for both programs at the same time. This is sometimes called concurrent benefits.

For example, if your SSDI payment is very low because you had limited earnings, and your total income remains under the SSI limit, you might receive a small SSI payment to bring you up to the federal minimum level.

This situation is more common than people realize, especially for workers with spotty employment histories or lower wages.

Health Insurance Differences

Another important detail involves health coverage.

If you qualify for SSDI, you typically become eligible for Medicare after a 24 month waiting period. This is federal health insurance that can help cover hospital and medical expenses.

With SSI, eligibility for Medicaid often begins immediately upon approval, depending on the state. Medicaid can be critical for people who need ongoing medical treatment and have very limited income.

So while both programs provide financial support, the health coverage that comes with them can differ significantly.

Why So Many People Get Confused

The names sound similar. Both programs are run by the Social Security Administration. Both require proof of disability. That overlap makes it easy to mix them up.

But once you focus on the key questions, the confusion starts to clear:

- Did you work long enough and pay Social Security taxes?

- Do you have very limited income and resources?

Answering those two questions usually points you in the right direction.

Choosing the Right Path

Applying for disability benefits can feel overwhelming, especially when your health and finances are already under pressure. The paperwork is detailed, the medical evidence must be thorough, and the approval process can take time.

Understanding which program fits your situation helps you avoid delays and denials. It also sets realistic expectations about what kind of support you might receive.

Some people discover they qualify for SSDI because of years of steady work. Others realize SSI is their only option due to limited income and no work credits. A smaller group finds they meet the criteria for both.

The important part is knowing how the system separates these two programs, one based on what you earned, the other based on what you need. Once you see that distinction clearly, the path forward becomes far less confusing, and the forms start to make a little more sense.